36+ How much can u borrow for a mortgage

What Are Current Mortgage Rates. A debt-to-income ratio below 36 and a down payment of 20 to accompany their 100000.

25 Loan Agreement Form Templates Word Pdf Pages Free Premium Templates

Department of Veterans Affairs VA loan carried an interest rate of 299 according to mortgage application processing software company Ellie Mae.

. Investment property mortgage rates can range from 50 to 875 basis points higher than rates on a primary home. You can calculate your mortgage qualification based on income purchase price or total monthly payment. FHA loans generally require lower down payments as low as 35 of the home value while other loan types can require up to 20 of the home value as a minimum down payment.

While the average rate isnt too high some personal loan lenders offer loans with annual percentage rates of up to 36. However as a drawback expect it to come with a much higher interest rate. Continental baseline at 647200.

Will mean you pay roughly 943 in interest over a 36-month. The type of mortgage you choose can have a dramatic impact on the amount of house you can afford especially if you have limited savings. However if you exceed the 702000 loan limit your mortgage will classified as a non-conforming conventional loan.

Its an important metric that lenders use to determine how much you can borrow or if you can borrow at all. If you took a mortgage at 500000 for a 2-unit home it is considered a conforming loan. 2836 are historical mortgage industry standers which are.

How lenders decide how much you can afford to borrow. This drastically affects how much they can borrow for a mortgage. This calculator shows how much you pay each month each year throughout the duration of the loan for each 1000 of mortgage financing.

Groceries and savings when thinking of how large a mortgage you can afford. You can take a 100 percent mortgage if youre looking to secure a home loan without making a deposit. For example if youre using the 25 post-tax rule and you bring home 5000 per month that means sticking with a mortgage payment of up to 1250.

To qualify for a mortgage for rental property your DTI should ideally fall between 36 and 45. Fixed-rate loans are ideal for buyers who plan to stay put for many years. This mortgage finances the entire propertys cost which makes an appealing option.

In December 2021 the average 30-year US. How much of the cars value you borrow and what happens at the end of the lease or loan term. The mortgage qualifier calculator steps you through the process of finding out how much you can borrow.

Using a percentage of your income can help determine how much house you can affordFor example the 2836 rule may help you decide how much to spend on a home. A mortgage would allow you to make that 30000 payment while a lender gives. The average 30-year Federal Housing Administration FHA loan by contrast was much more expensive with an average interest rate of 339.

However many popular loans with a max DTI of 43. Qualifying for a personal loan with a low rate one with an average rate and one with a sky-high rate often comes down to your credit history and. While you may have heard of using the 2836 rule to calculate affordability the correct DTI ratio that lenders will use to assess how much house you can afford is 3643.

The rule states that your mortgage should be no more than 28 percent of your total monthly gross income and no more than 36 percent of your total debt. How much house can I afford. For example you probably cant pay 400000 for a home upfront however maybe you can afford to pay 30000 upfront.

The amount you can borrow for a mortgage depends on many variables and income is just one of them. Lenders look most favorably on debt-to-income ratios of 36 or less or a maximum of 1800 a month on an income of 5000 a month. A 30-year fixed loan might give you wiggle room to meet other financial needs.

There are two main differences between a car lease and a car loan. How expensive of a home can I afford with an FHA loan. This ratio says that your monthly mortgage costs which includes property taxes and homeowners insurance should be no more than 36 of your gross monthly income and your.

If this is the maximum conforming limit in your area and your loan is worth 600000 your mortgage can be sold into the secondary. Once you know the monthly payment you can afford you can use a mortgage calculator to see what mortgage amount and down payment can get you to that monthly payment amount. In many cases homebuyers can borrow up to 548250 with a VA loan but you may be able to borrow more in areas with a higher cost of living.

As an example if mortgage rates for a 30-year fixed-rate mortgage on an owner-occupied home are averaging about 325 you might expect a 30-year investment property loan to have a 375 to 4125 interest rate. Note both loans aim for a 36 DTI which is typical for a conventional mortgage. FHA-insured loans are meant to help people with low or no credit high debt or low funds qualify for a mortgage.

The average 30-year fixed mortgage rate rose from around 3 in December 2021 to 581 in June 2022 according to Freddie Mac. In many cases borrowers can count 75 of their potential monthly rental income as determined. Other lenders may charge even higher rates for small loans for bad credit.

With the money factor of 005 which translates to a 12 percent interest rate. Best Auto Loan Lenders Rates. This calculator adds in discount points loan origination fees and closing costs along with any recurring PMI fees into the loans original APR to figure out the effective cost of your loan with all these.

An optimal DTI is 36 or below including possible housing costs but excluding current rent payments if any. By default this calculator uses a 28 front-end ratio housing expenses versus income a 36 back-end ratio monthly housing plus debt payments versus income though these are variables in the calculator which you can adjust to suit your needs the limits set by your lender. Summary of Moneys guide to home.

For 2022 the FHFA set conforming limits for single-unit homes in the US.

Kentucky Rural Housing Development Mortgage Guide For 2021 Usda Loans Kentucky Usda Mortgage Lender For Rural Housing Loa Usda Loan Mortgage Loans Home Loans

25 Quotes That Will Change How You Look At Money Financial Quotes Money Quotes Financial Freedom Quotes

Your Debt To Income Ratio Is All Your Monthly Debt Payments Divided By Your Gross Monthly Income This Number Is Debt To Income Ratio Home Buying Process Debt

25 Loan Agreement Form Templates Word Pdf Pages Free Premium Templates

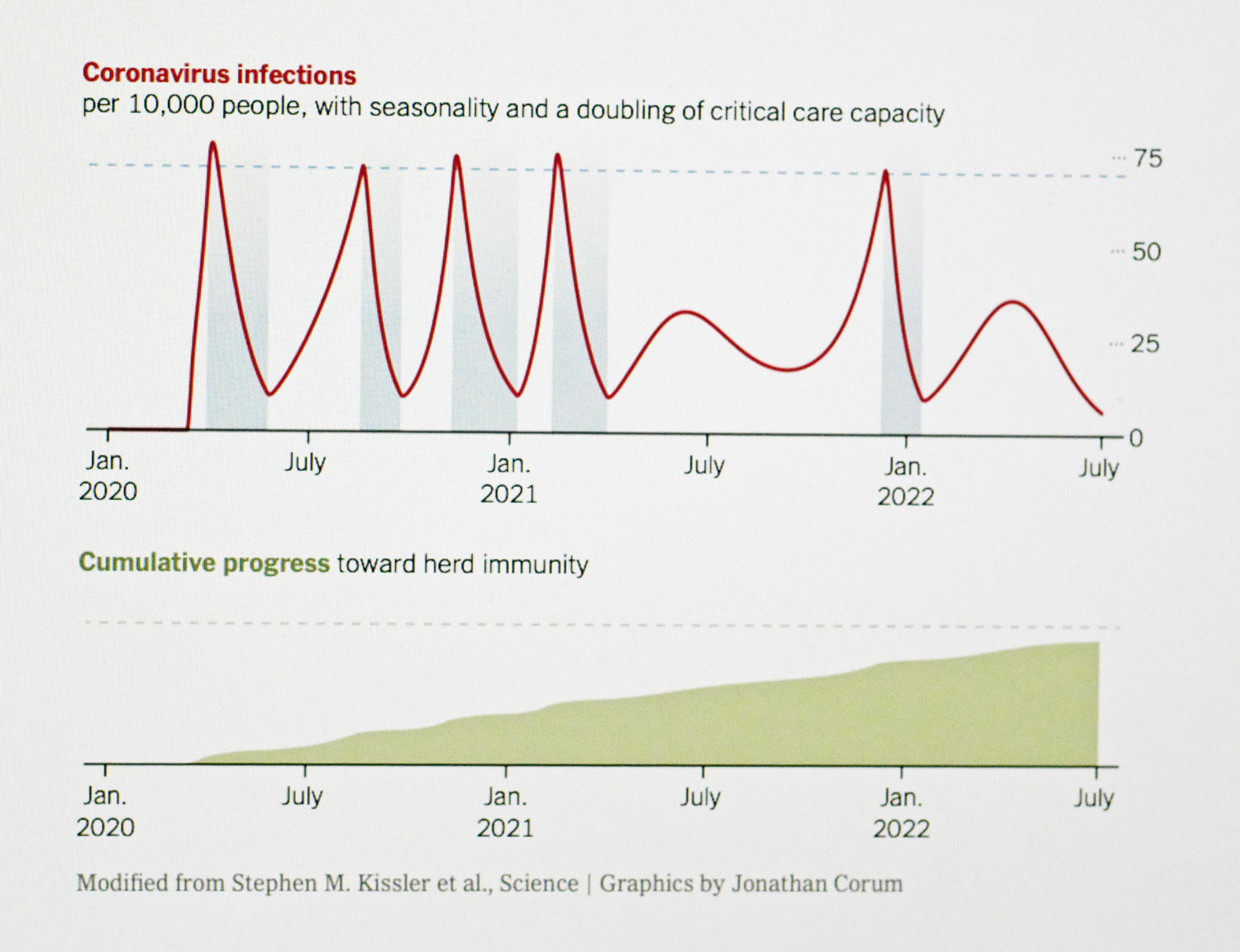

Covid Cyclical Seasonal Graph Jpg

Are You Thinking Of Getting A Reverse Mortgage Who Should Consider One And Who Shouldn T U Estate Lawyer Real Estate Reverse Mortgage

Deuteronomy 28 12 Yahweh Will Open To You His Good Treasure In The Sky To Give The Rain Of Biblical Quotes Inspirational Gods Guidance Annoying People Quotes

36 Sample Letter Of Explanation Templates In Pdf Ms Word

10 K

Online Payday Loans That Accept Disability In Canada Finder Canada

Your Mouth Is Telling Me You Can T Afford To Pay Back The Money I Loaned You But The New Shoes On Your Feet Are Telling Me Another Story Money Quotes Funny

U Reasonandmadness Explains To A Boomer What Okay Boomer Means By Those Using It And Why It Means What It Means To Them R Bestof

2

Pin By Joanne Kuster On Money Budgeting Ideas Budget Creator Budgeting Scholarships

5000 Years Of Interest Rates Gif

How To Fix An Error On Your Credit Report A Guide Credit Repair Credit Report Credit Repair Diy

Mortgage Note Sample Check More At Https Nationalgriefawarenessday Com 33628 Mortgage Note Sample