179 depreciation calculator

Section 179 of the IRS tax code gives businesses the opportunity to deduct the FULL purchase price of qualifying new and used equipment and software placed into service during the tax. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators.

Ready To Use Section 179 Deduction Calculator 2021 Msofficegeek

The Section 179 Tax Deduction is meant to encourage businesses to stay competitive by purchasing needed equipment and writing off the full amount on their taxes for the current.

. Results Section 179 Deduction. Make your pharmacy more productive profitable when you use this tax benefit with Parata. Make your pharmacy more productive profitable when you use this tax benefit with Parata.

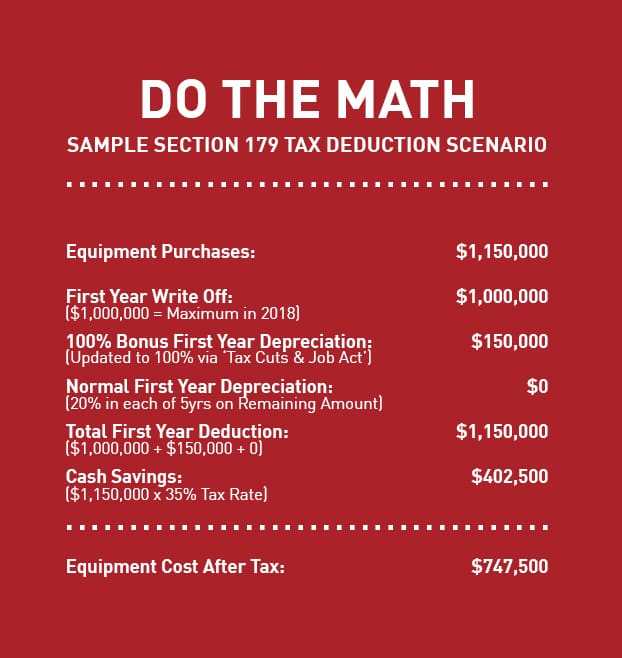

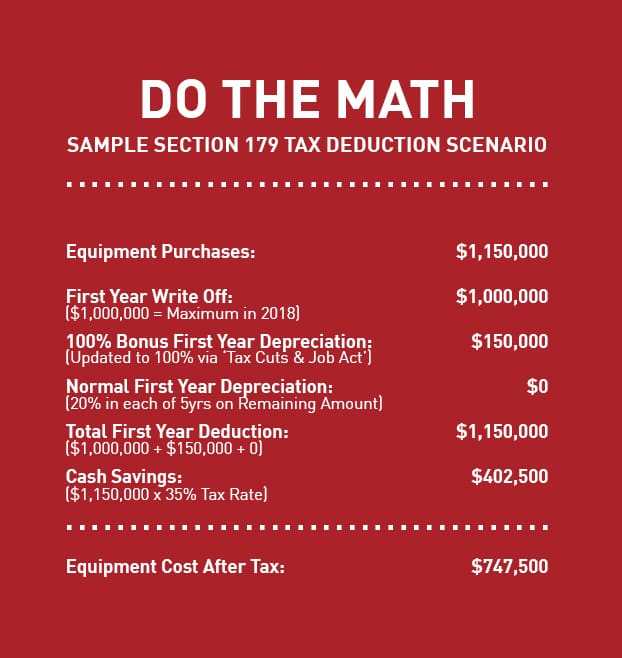

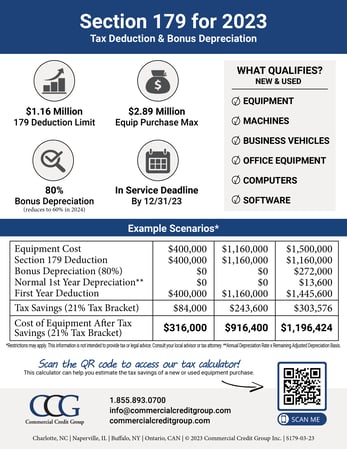

The Section 179 Deduction and Bonus Depreciation apply for both new and used equipment. The 2022 Section 179 deduction is 1080000 thats one million eighty thousand dollars. Section 179 Tax Deduction calculator an easy to use calculator to estimate your tax savings on equipment purchase through section 179 deduction in 2019 and tax year 2018.

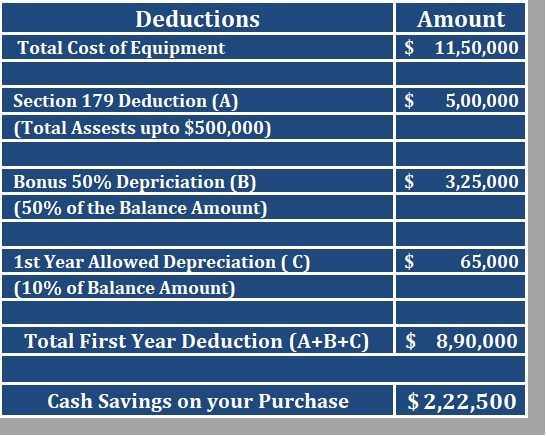

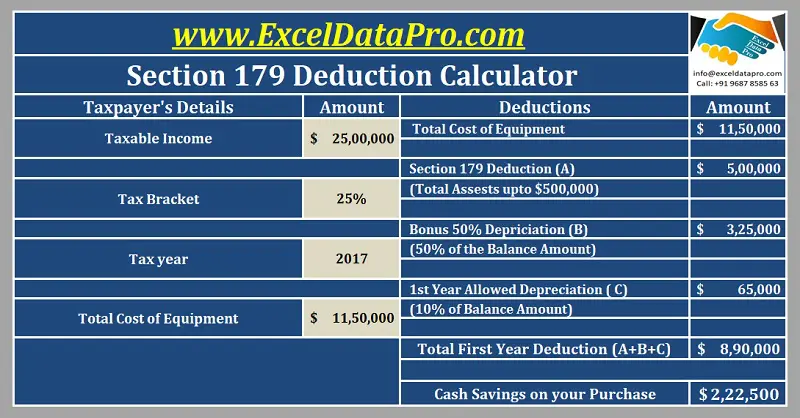

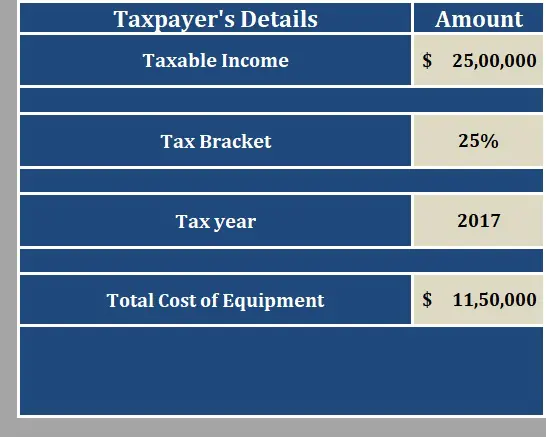

IRS Section 179 Deductions Highlights Most new and used equipment as well as some software qualify for the Section. Section 179 calculator for 2022 Enter an equipment cost to see how much you might be. Use the Below Calculator to Check Your 2017 Section 179 Deduction.

2022 is The Highest Deduction Ever for Section 179. Example Calculation Using the Section 179 Calculator Using a 75000 equipment cost for a sample calculation shows how taking advantage of the Section 179 Deduction can. Just enter your equipment cost below.

Ad Trade some of your pharmacys tax bill for new tech - Section 179 offers a way to save. 1 in-depth understanding of the types and amounts of qualifying short-life assets 2 statistical. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments.

Try out our 2021 calculator below to see how this works. The total section 179 deduction and depreciation you can deduct for a passenger automobile including a truck or van you use in your business and. Depreciation per year Asset Cost - Salvage.

Equipment Cost. 2022 Example Cost of equipment 3000000. With a 1050000 deduction limit youll be able to deduct the full cost of equipment and get.

Depreciation limits on business vehicles. Section 179 can save your business money because it allows you to take up to a 1080000 deduction. If youre wondering how Section 179 and bonus depreciation could affect your business tax deductions check out the calculator below.

The bonus depreciation calculator is proprietary software based on three primary components. So the more a business spends over 2620000 on equipment the more their 1050000 deduction starts to go down. 1 Cost of Equipment.

Simply put in the cost of the. A full 30k jump from last year. To make calculating Section 179 easy weve built this Section 179 calculator for 2017.

See how much you can save with this easy-to-use calculator. Section 179 does come with limits - there are caps to the total amount written off 1050000 for 2021 and limits to the total amount of the equipment purchased 3670000 in 2021. Get an estimated tax write-off amount for qualifying Section 179 property that you purchase in 2022.

This calculator has been fully updated for the 2022 tax year. For passenger vehicles trucks and vans not meeting the guidelines below that are used more than 50 in a qualified business use the total deduction including both the Section 179. With this method the depreciation is expressed by the total number of units produced vs.

10000000 Bonus 100 Depreciation. Ad Trade some of your pharmacys tax bill for new tech - Section 179 offers a way to save. The total number of units that the asset can produce.

Show Savings Section 179 Deduction. The allowance is an additional deduction you can take after any section 179 deduction and before you figure regular depreciation under MACRS for the year you place the property in service. Use the Section 179 Deduction Calculator to help evaluate your potential tax savings.

Calculate your potential savings with our 2022 Section 179 tax deduction calculator.

Ready To Use Section 179 Deduction Calculator 2021 Msofficegeek

Download Section 179 Deduction Calculator Excel Template Exceldatapro

Download Section 179 Deduction Calculator Excel Template Exceldatapro

Section 179 Deduction Hondru Ford Of Manheim

Ready To Use Section 179 Deduction Calculator 2021 Msofficegeek

Download Section 179 Deduction Calculator Excel Template Exceldatapro

Free Section 179 Deduction Calculator For Us Internal Revenue Code

11 Common Questions Small Business Owners Ask About Section 179 Deductions In 2018 Custom Truck One Source

Section 179 Calculator Ccg

Section 179 Calculator Ccg

2021 Section 179 Deduction Calculator Guide For Equipment Equipment Radar

Calculate Your Potential Section 179 Tax Deductions On New Equipment Bpi Color

Macrs Depreciation Calculator With Formula Nerd Counter

Section 179 Depreciation Tax Deduction 2016 2019 Taycor Financial 2016 02

Macrs Depreciation Calculator With Formula Nerd Counter

Bellamy Strickland Commercial Truck Section 179 Deduction

Section 179 Tax Deduction Calculator Internal Revenue Code Simplified